Welcome to Day 7 of our series on building your Home Management Binder.

Update!

You can now find this printable in EDITABLE format in my Printables Shop HERE.

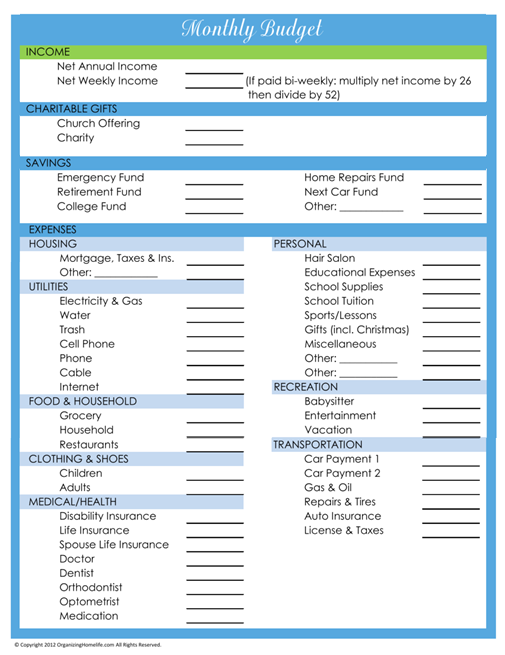

Today’s printable is my Monthly Budget. I realize that people use all types of budgets and share many different opinions on the subject of budgeting their money. I do not intend to offer financial advice or suggest that this is the only way to budget. Nor do I wish to offend anyone who is struggling financially or is out of work. I hope this budget will be an inspiration to you to help you gain control over your money so it doesn’t control you!

I decided to share with you the budget I use and how it has helped my family. It is based on Dave Ramsey’s Total Money Makeover.

I didn’t think I could live with a budget, but after reading the inspirational stories of real life families in his book, I was willing to give it a try. I am SO glad I did. It takes a little getting used to, but I began to realize very quickly how much money I was spending on unimportant things. I thought I was frugal and didn’t waste money – until I read the book. 🙂

Now, just in case you’re wondering, I’m not turning this post into a preaching session on how Dave Ramsey saved us from financial ruin. I am going to tell you that setting up a budget for your family is one of the best financial choices you can make, but it has to be a personalized budget that works for you!

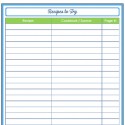

Here is what my budget looks like. Feel free to download it, but please respect my copyright (listed below).

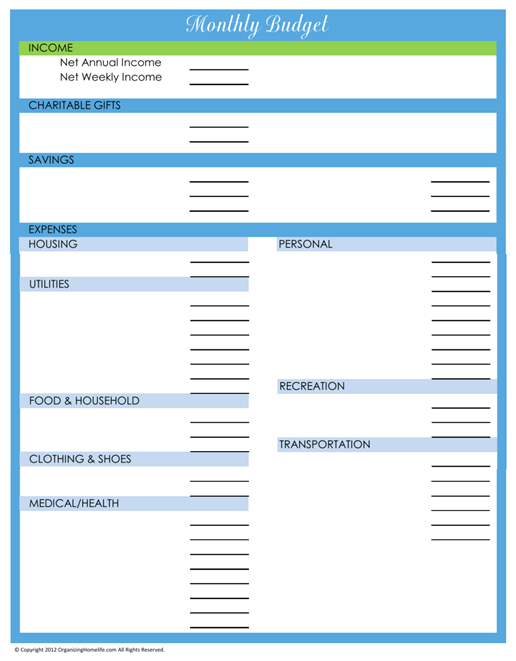

To download my budget, simply click on the image. There is a blank one at the end of the post, too!

Here is how I set mine up:

1. Write your net annual income on the first line. If you are paid weekly, you already know what you earn each week. 🙂 If you are paid bi-weekly, multiply your net income by 26, then divide it by 52. That will give you the total amount of money you have to save and spend each week.

2. We give an offering out of every paycheck, so I take that out first.

3. From here on out, you will be subtracting from what is left of your weekly income.

*Note* This may take some time and adjustments over the course of weeks or months until you come up with a budget that works for you!

4. Using the same method as described for your income, you need to figure out how much money will come out of your weekly pay for ALL of your expenditures (even your trips to Starbucks). If it’s a monthly bill like your mortgage, multiply it by 12 and divide it by 52. For example: If your mortgage is $1,000 per month, you would multiply it by 12 = $12,000/year. Then divide by 52 = $231/week needs to come out of your weekly pay. If you have a quarterly bill, multiply by 4, divide by 12. Get it? If you spend $15 bucks a week on coffee, budget it in!

5. Fill in all of your essential, non-flexible expenses first. That includes your mortgage, car payments, etc. These are bills that you know are the same every billing cycle.

6. Next fill in your essential bills that have fluctuations in expense, like your gas and electric bill. Look at your bills over the last 12 months. Add them up and divide by 52. That will give you an average of how much you spend per week on gas and electric. If it looks like you’re taking way too much out each week, just remember, winter heating bills are coming (or summer’s air conditioning)!

7. Next, begin to fill in the categories that you have some control over like groceries and clothing. They ARE necessities, but you obviously aren’t going to spend $100 on a new pair of shoes if you need new tires on your car in the same week. You might need to shop at a discount store for shoes if you must have them that week. There IS flexibility there.

8. Definitely plan in the fun! Don’t forget to budget for your favorite things! No one can stick to a plain ol’ boring diet, and no one can stick to a too-tight budget, either! If you know you’re tight on money, but you really want to go to lunch with your friend this week, plan for it! Have spaghetti for dinner, or skip those extra trips to McDonald’s this week.

9. Remind yourself that you can do it! This budget works for me because although there are definitely weeks where I’m bummed because the money is gone before the week is out, I know it will reset for the next week. We get paid bi-weekly, but since our budget has been set up weekly, the amount of money I am allotted to spend is renewed every week. Some things must purchased, but most things can wait for a week. 🙂

10. Most importantly, when you begin to budget, you are making sure you know where your money is being spent. You know you are paying your bills responsibly, not racking up debt, and you don’t have to feel guilty about having fun!

I cannot recommend Dave Ramsey’s books highly enough. He explains all of this in much greater detail than I can get into in this post.

Best wishes as you begin your new budget!

Tips for downloading successfully:

You must have a PDF reader installed in order to view these printables. If you haven’t already, please visit adobe.com and download their latest version of acrobat reader. It’s totally free.

Printables are viewed the best in Google Chrome, Safari, or Firefox internet browsers. Internet Explorer seems to have trouble with printables.

Feel free to download this printable, but please respect my copyright. This printable is © Copyright 2012 Organizing Homelife and is intended for personal use only. Please do not distribute this file for free or for profit without written consent. Thank you!

Feel free to click through to all of the 31 Days below, or you can purchase the entire set in one downloadable file here.

Thank you, Ginny. We get paid once a month and I find we’re getting a bit “broke” toward the end of the month, so we obviously need to be budgeting our weeks better!

My “31 Days” topic is budgeting, so I’ll be linking to this post for sure! I love your printable and the fact that you included a blank one. So thoughtful of you. 🙂

So far, yours is the only 31 days series I’m following daily since blogging every day makes it difficult to participate in more. My next organizational goal (after October) is to actually set up and start using my home management binder that’s been partially done for an embarrassingly long time. I’m grateful that I’ll have your printables to use.

I’ve read Dave’s books, and my husband and I have taken FPU. We are just now to the point where we can almost make a budget! Due to the debt that we have, it’s just never been possible. We have been blessed to have been able to live with my in-laws so that we could keep up with our bills. Thankfully we’re using no more credit and working hard to dig out of debt! I love your budget form, and I love how well you explain the steps!

Thanks so much!

Anyway you can make the blank budget form have lines OR make it so we can type our stuff in it? Either way, THANK YOU for this generous gift! I’ve tried to start a binder SO many times. THIS time I am going to do it!!!

Thank you so much for the awesome downloads!! And the explanations that go along with them. Very nice!!

Thanks, Kim. I’m glad you’re enjoying them! 🙂

I love this, but what do you do if your income varies week to week? My hubby gets paid hourly. Sometimes he works a lot of hours in a week, sometimes he works only a few. The outgoing expenses are not a problem to put in, but I don’t know what to do about the income since it’s never the same. I could put in what he would make if he worked 40 hours for the week, but that rarely happens.

Great question, Debbie. I wish I could answer from experience, but my husband and I learned to budget this way on a salary. My hubby worked hourly for many years, so I know how difficult it is to try to budget on a variable income! My thought is that maybe you can take an average of what he earned over the last 6 months or year to come up with a fairly accurate weekly or bi-weekly figure. I can HIGHLY recommend Dave Ramsey’s book that I mentioned in the post. It has a ton of examples and I’m sure it would answer your question much better than I could. Best wishes. 🙂

Dave Ramsey DID save us from financial ruin! Thank you for sharing his budget on your blog. I hope it inspires others to check out his system.

🙂

By the way: I’m now following your blog! LOVE IT!

You’re welcome, Cortney. I’m so glad to hear that you were helped, too. Thanks for following me. 🙂

This is a great site, and I have added you to my blog list to follow! I am so happythat the News and Observer featured you in theri Top Drawer Collumn today, this is a great site! I am looking forward to shring it with my adult daughters as well! I love your printables, thanks for sharing!

I have a blog also, very different than yours. Its currently about angels, but follows our Red Hat Society group, and talks about other issues dear to my heart. It’s url is: http://www.heartofasouthernwoman.blogspot.com

if you want to check it out. This is a great site! Looking forward to learing more!

I found your blog today while I was searching for home management printable. I have been a full-time home manager for 17 years and am always looking for better ways to do things. I like what I have seen on your blog and appreciate your humble and helpful writings. Keep up the good work. Your love for Christ shines through!

Thank you so much for such a sweet comment, Deanne. That really meant a lot to me. God bless! 🙂

I’d love to use this template but do I have to print it and write it in by hand? Is there a way to type in what I want first (personalize it) and then print it out? I’m not great with computers so this might be an easy answer and I’m just oblivious!!! Thanks for doing this! It looks great!

Hi Nicole. The editable budget is now available in my shop for just $2. You can edit the entire thing. 🙂 Check it out here: http://96.30.21.56/~organiz/archives/5930

you should change the years available fir the journals